35+ Minimum payment on 5000 credit card

Your monthly payment is calculated as the percent of your current outstanding. The minimum payment on your credit card statement is the smallest dollar amount you must pay in a given month.

Blockfi Review Spendmenot

If you only make your minimum.

. The Ink Business Preferred Credit Card belongs to the Visa Signature Business Credit Card program guaranteeing a minimum credit limit of 5000. Credit Card payments are typically setup to deduct the minimum monthly repayment this will normally be calculated as a percentage of the outstanding balance. Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater.

The interest rate or APR is 25. To see the impact of paying off a credit card with minimum payments only consider a credit card balance of 5000 at the current. There is usually a dollar amount for your minimum monthly payment also so it may be expressed as something like 35 or 2.

The minimum payment on a 5000 credit card balance is at least 50 plus any fees interest and past-due amounts if applicable. The minimum payment on a credit card is the lowest amount you must pay to avoid paying late charges and damaging your credit score. If you were late making a payment for the previous billing.

If your credit card balance is. The below example is for. The minimum payment is usually a percentage so how much youll pay will depend on a couple of things the amount you owe and your credit card providers rules.

A minimum payment of 3 a month on 15000 worth of debt means 227 months almost 19 years of payments starting at 450 a month. Minimum Payment Maximum Cost. If you were late making a payment for the.

If you own a small. The minimum payment on a 5000 credit card balance is at least 50 plus any fees interest and past-due amounts if applicable. Your minimum payment is calculated as a small percentage of.

By the time youve paid off the 15000 youll. Which includes missed or late. Youve borrowed 2000 on a credit card and the card has a 25 minimum monthly payment.

The minimum payment on a credit card is the lowest amount of money the cardholder can pay each billing cycle to keep the accounts status current rather than late. When you fail to pay at least the minimum amount or miss a payment entirely there are several negative consequences depending on the type of late payment. So if you owe 2000 your minimum payment might be 40.

For credit cards this is calculated as your minimum payment. This is your initial monthly payment.

Pabbly Subscriptions Subscription Billing Management Software

Financial Service Partners

Current Report 8 K

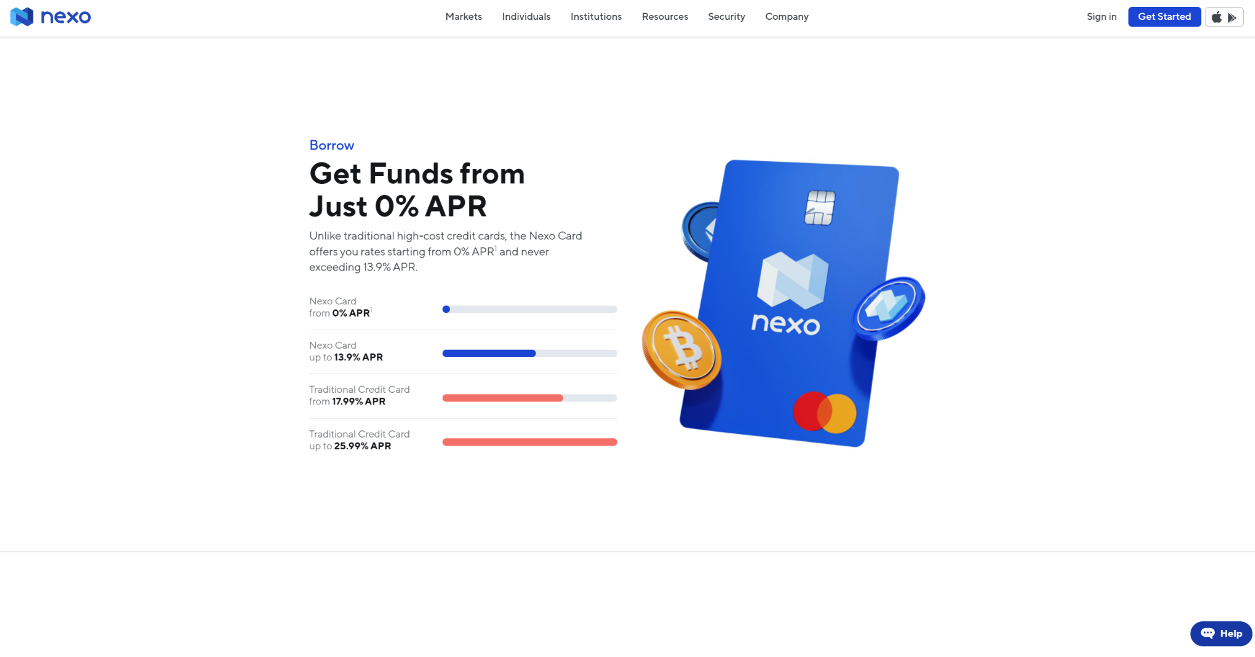

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

Square Review Fees Complaints Lawsuits Comparisons

Do Millennials Prefer Debit Cards To Credit Cards What Does The Evidence Say Quora

Square Review Fees Complaints Lawsuits Comparisons

I M 18 With No Credit History What Is The Best Smartest Way To Start Building Credit And With Which Credit Card Quora

Is Credit Card An Example Of Near Money Quora

Financial Service Partners

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

What Is The Best Credit Card For Young Adults Quora

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

Financial Service Partners

Can You Get A Credit Card And Add An Authorized User And Have That Authorized User Use Those Charges As A Tax Write Off For Their Business If They Are The Only Ones

Instant Lift Front Cross Side Buckle Lace Brablue Xxl In 2022 Instant Lifts Lace Bra Push Up

Credit Card Payment Calculator For Microsoft Excel Excel Intended For Credit Card Payme Credit Card Payoff Plan Credit Card Statement Paying Off Credit Cards